The following articles and statements are provided for public information and copyright vests in the Development Bank of Namibia. For permission to use these items verbatim, or as excerpts, or for photographic permissions, please contact the Corporate Communications and Stakeholder Relationships Specialist on 061 290 8000.

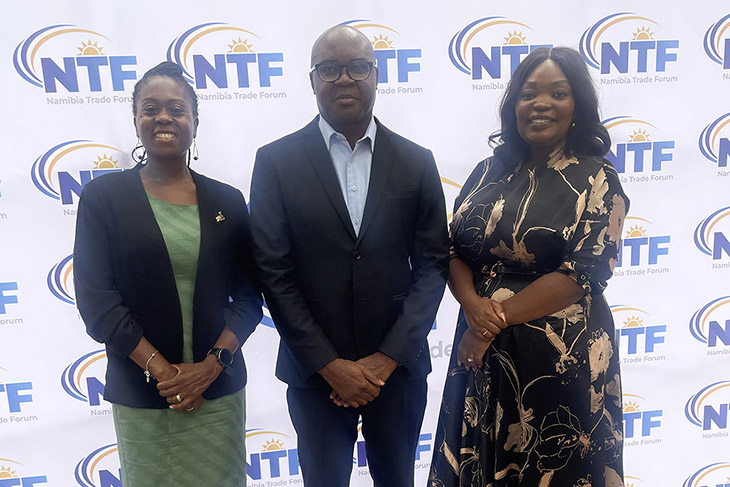

Towards AfCFTA trade. Namibia Trade Forum and Development Bank of Namibia concluded memorandum of understanding to strengthen export trade. Pictured at the launch of the memorandum are (FLTR) Ndiitah Nghipondoka-Robiati of the Ministry of Industry and Trade, Development Bank CEO Martin Inkumbi, and Namibia Trade Forum CEO, Stacey Pinto.

NTF and DBN launched an MoU in terms of which NTF will assist export-oriented enterprises and start-ups to apply for DBN finance. The MoU will also cover enterprises engaged in internal trade.

Delivering the keynote address at the launch, Deputy Director for International Trade and Commerce in the Ministry of Industrialisation, Trade and SME Development, Ndiitah Nghipondoka-Robiati, said at a time when Namibia and the Africa continent are working towards greater integration this MoU, aims to improve and strengthen the SMEs and allows Namibia to accelerate its industrialisation agenda and diversify its export market.

Robiati reiterated that SMEs are the backbone of most economies and are a key source of economic growth dynamism and flexibility, so SME’s must engage in programs that foster entrepreneurial thinking and enhance entrepreneurship.

Robiati concluded that, collaboration such as the NTF-DBN MoU, and commitment and consistency are the three factors which will enable SME’s to become highly independent and increase their survival rate.

Stacey Pinto, CEO of NTF said that the collaboration is geared to strengthen applications for DBN by SMEs. NTF, she said, should be a first stop for SMEs intending to export goods or services to AfCTFA countries.

Among advice to strengthen DNB applications that NTF will provide, Pinto highlighted certain standards that will allow SMEs to compete in AfCFTA, elements such as packaging, labelling, barcodes, production capacity, and quality assurance. These elements, she emphasized, are the basis for SMEs to invest in products and services.

DBN CEO Martin Inkumbi highlighted the Namibian paradox of a highly developed enterprise financing and support ecosystem yet inefficient enterprise formation. This inefficiency is characterized by substandard performance of new and existing enterprises, as well as their failure.

According to Inkumbi the inefficiency is due to lack of entrepreneurial skills, limited demand for local goods and services, and lack of coordination in the enterprise financing and support ecosystem.

The MoU, he said, should be a model for coordination with the ability to assist finance for manufacturing, food processing, agriculture infrastructure with the goal of local and AfCFTA trade.

He cautioned that although AfCFTA represents a potential boom for Namibian exporters, it also opens Namibia to imports, and so it is important for Namibian SMEs and manufacturers to be competitive in both local and export markets.

Inkumbi concluded by expressing hope that the partnership would be energetic and effective.