Call 061 290 8000

Call 061 290 8000 Click to mail us

Click to mail us FAQs

FAQs

DBN

Head of Marketing and Corporate Communication, Jerome Mutumba, has clarified the DBN's role and participation in agricultural finance, stressing that finance for direct agricultural investments is a mandate held by Agribank, but that Development Bank can provide finance for agri-enterprise.

Find out more about finance for agri-enterprise, here...

Explaining DBN’s definition of direct agriculture, Mutumba says it entails finance for land and agricultural inputs. However, agri-enterprise, he says consists of adding secondary value to agricultural operations, as well as resource transformation of agricultural produce. Development Bank will consider finance for agri-enterprise.

Mutumba goes on to split the Bank’s finance for agri-enterprise into three distinct fields.

Firstly, he says agri-industry is enterprise activity that manufactures products to support agriculture, such as fertilizers and feeds. This category might also include professional services to agriculture, such as veterinary services, welding and fabricating, and mechanical repairs, he continues, alluding to the Bank’s skills-based finance for young professionals and artisans.

Secondly, agri-processing consists of transforming and marketing the products of stock farming and horticulture, with finance for items such as mills, feedlots, abattoirs, dairies, processing facilities and transport and logistics assets.

Thirdly, he points to the Bank’s climate adaptation facility. Infrastructure financed under this facility might include solar power, water storage and water distribution for larger agricultural enterprises.

The Bank has a strong track-record in the field of agri-enterprise, including finance for abattoirs, feed lots, dairy production and milling plants. The Bank sees agri-enterprise as a growth area, Mutumba quips.

Talking about the Bank’s rationale for participation in the field of agri-enterprise, Mutumba says that Namibia has prioritised food security since its inception through manufacturing, as well as long-standing support to commodity level processing such as milling, for instance.

Mutumba says that with the supply chain crisis as well as current pressure on grain and oil used in food preparation, support to agri-enterprise is more important than ever before. Given Namibia’s challenge to substitute grain and cooking oil production, it has become all the more important to find means to stimulate the production of local foodstuffs that can be used as nutritional substitutes for imported agricultural commodities.

Given the reported waste of approximately 45% of horticultural foodstuff due to a shortage of processing and packaging, he adds, finance for value adding through manufacturing, and transport and logistics can also enhance food security.

At the same time, he acknowledges the challenges faced by smaller farmers, but says the Bank advocates that networks of small famers establish companies, in which they are shareholders, to spread collateral and owner’s contribution requirements, as well as to ensure that consistent and sufficient supply of produce is available.

Mutumba goes on to say that with Agribank’s finance for direct agriculture, the Namibia Agronomic Board’s Market Share Promotion mechanism to drive local horticultural supply chains, and Development Bank’s finance for food manufacturing, the country has a strong basis for enhancing its own food security. There is a sound institutional environment that supports agriculture.

If you are in the field of agri-processing, or any form of value addition to agricultural produce, and have a viable business plan, approach Development Bank to see how we can support your growth, Mutumba concludes.

French development agency, Agence Française de Développement (AFD) and Development Bank of Namibia (DBN) have signed an agreement in terms of which AFD will provide €300,000 (about N$5,020,000) in grant funding for two DBN research programmes; investigating opportunities in the fields of affordable housing and the development of Namibian women entrepreneurs. The agreement was signed by DBN CEO Martin Inkumbi, H.E. Sébastien Minot, French Ambassador to Namibia, and Bruno Deprince, AFD Regional Director for Southern Africa.

Speaking about the research, Martin Inkumbi said the institution is not just a source of finance but also a knowledge bank and brains trust for development of economic activity. Although the bank may have financial and administrative capacity, development impact depends on the ability to bring the financial resource to bear in knowledgeable and effective manner.

He went on to express his gratitude to AFD, French ambassador Sébastien Minot and the Republic of France.

Inkumbi also explained the need for research.

In terms of low-cost housing, the Bank will seek to understand market impediments to developing low-cost housing schemes, means to incentivise construction of low-cost housing schemes and appropriate financing products to individuals to purchase such properties.

In the field of women entrepreneurs, is investigating dedicated finance and required support programs for women entrepreneurs. Research will strengthen DBN’s impact by creating market profiles of the women segment, developing tailored products as well as understanding barriers to economic inclusiveness.

Speaking at the signing ceremony, the French ambassador to Namibia, Sébastien Minot said to be honoured to witness a new step for the Franco-Namibian cooperation. Although AFD has been active in Namibia since 1998, it is the first time that a project will be conducted in cooperation with DBN. He is looking forward to engaging new opportunities that will strengthen the ties between the two countries. Minot insisted on France’s commitment to target through cooperation essential challenges and sustainable development goals as SDG 11 on sustainable cities and communities and SDG 5 on gender equality. In 2021, the French Embassy to Namibia has initiated the Fem-Tech project was created to support and develop innovative Namibian female tech entrepreneurs.

As AFD counts developing the access to affordable housing and women empowerment among its strategic priorities, the delegation is excited about contributing to that new project. Bruno Deprince, Regional Director of AFD for Southern Africa, also insists on the future of this partnership as the results of the financed studies and analysis could help developing new financial products to address the identified needs within the project.Agence Française de Développement is looking forward implementing the results while being at the side of its new partner.

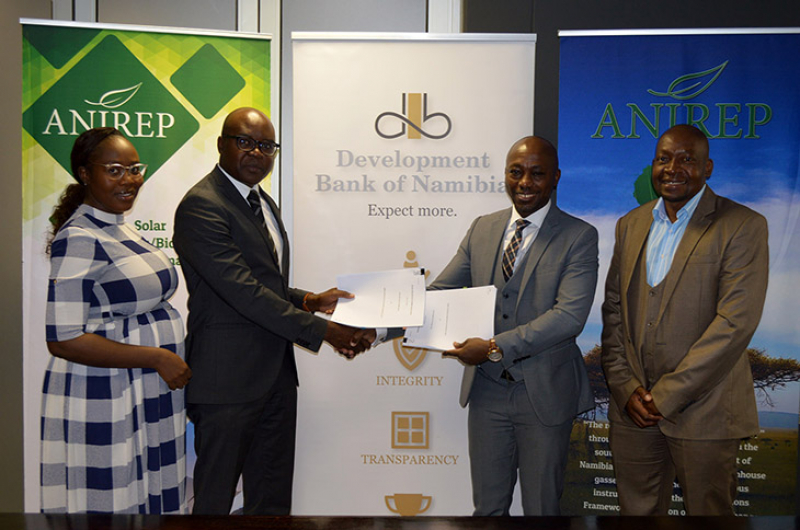

Development Bank of Namibia (DBN) has signed an agreement to provide N$193 million to finance a new solar power generation plant, near the Kahn substation in the Namib Desert. The plant will feed 20 MW into Nampower’s Kahn substation, from where it will be distributed to households and industrial consumers.

Anirep Aussenkjerr Solar One, a start-up company, was the recipient of a 25-year tender to produce power for Nampower. The company consists of two local partner companies, Anirep Solar and Aussenkjer Energy Investments. Anirep is listed on the Namibian Stock Exchange.

The solar plant, 40 km from Usakos, will be developed by HopSol Africa, also a local company.

Talking about the importance of solar power for Namibia, DBN Head of Marketing and Corporate Communication, Jerome Mutumba pointed out that according to National Statistics Agency (NSA) figures for February 2022, local production of electricity stood at 65 362 but imports from the Southern Africa Power Pool stood at 255 286 MWh.

Mutumba said that these figures were a snapshot of the current need to substitute imports. He said that viewed over the short, medium and long-term local generation was highly variable due to the fact that Namibia’s largest power generation facility, Ruacana Hydroelectric Power Station is dependent on fluctuating levels of the Kunene River.

He illustrated the impact of the levels of the Kunene River by saying that in July 2021, power production from Ruacana Hydroelectric Power Station fell by 87.5%.

Mutumba then said that this decline points not just to develop local power generation, but also to the need for stable sources of generation, such as solar.

Fluctuation in generation leads to fluctuations in costs which have an impact on Namibia’s deficit as well as on the medium to long-term costs of industry as Nampower and regional distributors have to adjust their costs. By stabilising power generation, he said, Namibia can become a more attractive destination for investors seeking opportunities in Namibian industrialisation.

On the topic of privately-owned solar generation facilities, Mutumba said that independent power producers (IPPs) are an ideal means to promote economic inclusiveness. Currently, a small solar power plant can conceivably be financed over a period 10 years. With an offtake agreement of 20 to 25 years and a stable purchasing regime over an additional 10 to 15 years, this leaves an enterprise resource that can be maintained, expanded or diversified.

Mutumba concluded by saying that solar generation has benefits all round and urging all stakeholders to approach the Bank to examine business models and potential for future projects.