Call 061 290 8000

Call 061 290 8000 Click to mail us

Click to mail us FAQs

FAQs

DBN

The recent focus on empowering informal and microenterprise is a necessary affirmation for further development of Namibia’s economy. Development of new market spaces, as well as ongoing management of and upgrades to SME parks as good omens for the future.

An examination of Namibia’s recent enterprise history shows three broad origins of enterprise start-ups. The first is the local start-up, typically an informal or registered, regulatory compliant micro-enterprise. The second is a South African adjunct, an enterprise which complements the South African parent. The third, most rare form is an international start-up.

Of the three the informal or formal micro enterprise is arguably the most productive for Namibia. A survey of large Namibian enterprises points to the local, micro origination of many of Namibia’s best-known brands and companies.

The roots of the successes and sustainability of these enterprises lie in their small, relatively low-cost beginnings, the persistence of their owners in learning, adapting and diversifying. Thus, by example and inference, to develop large, economically significant, and sustainable Namibian enterprises, a wide base informal or formal micro enterprises must be fostered.

However, the value of the progression from an informal enterprise to a large formal enterprise is difficult to predict, especially given that there will be attrition of the informal enterprises in particular.

The economic value of informal and micro enterprises becomes more apparent when evaluated according to current development needs.

Firstly, informal enterprise is a major employer. According to Tangeni Shindondola, Director of the Dynamic Informal Traders' Association (DITA), as reported in The Namibian newspaper of 15 February 2022. She goes on to note that informal enterprise becomes an employment provider in the event of retrenchments.

Firstly, informal enterprise is a major employer. According to recent findings by the International Labour Organisation (ILO), as reported in the Namibian pf 6 September 2022, 56% of Namibia’s workforce in employed in the informal sector. According to Tangeni Shindondola, Director of the Dynamic Informal Traders' Association (DITA), as reported in The Namibian newspaper of 15 February 2022, informal enterprise becomes an employment provider in the event of retrenchments.

Secondly, informal enterprise is known to be a sole form of income for many households, or augments household incomes, particularly where those households are in poverty or on the verge of poverty.

Thirdly, informal and microenterprises are important elements of the value chain as off-takers and distributors of goods and services. This is true of goods and services produced by large and medium sized enterprises, with attendant impacts on formal enterprise revenues and employment. Informal and micro enterprises also generate network business on a peer level, creating their own ecosystem.

To reap longer term benefits from the informal and micro enterprise sector, activities need to be viewed and planned in four phases.

Firstly, nascent informal enterprise needs to be nurtured and enabled. Secondly, those informal enterprises with potential need to be encouraged to transition to formalised, registered, regulatory compliant microenterprises. Thirdly, microenterprises need to be nurtured to the activity level of SMEs. Finally, the most successful SMEs need to graduate to larger enterprises.

What is obvious is that the process of growth of informal and micro enterprises requires support and inducements.

The first inducement is a welcoming approach to start-ups. This requires liberalisation of the regulatory environment for informal enterprises, and removal of early barriers. Although regulation is required, that regulation should be exerted gradually, post start-up on the basis of impact on the community as well as the level of activity of the informal enterprises.

A second phase will be required to induce formalisation of the informal enterprise to become a fully-fledged micro enterprise, including full regulatory compliance.

The shift from informal enterprise to registered microenterprise entails costs which must be offset, including taxation and regulatory costs. To reduce the immediate burden, the enterprise will be required to grow, which will come at an expense. This can be offset with short-term bridging finance for stock and regulatory costs, and longer-term mezzanine finance to grow the asset base. This might be paired with concessional interest rates and use of assets financed as collateral.

What is also apparent is that formalisation requires an augmented skill set to manage finance in a borrowing environment, as well as administer the regulatory aspects. This can be addressed with mentoring and coaching of the type envisaged by the Bank of Namibia’s SME Financing Strategy.

What is implicit to a policy that nurtures informal and microenterprises is the need for a suitable agency to administer and coordinate finance, and mentoring and coaching.

The further benefits of an agency of this nature are that it will set the standards for services, and act as a control against predatory providers of microfinance. In addition, it may become a reference point for conducive regulatory practices. Finally, it may become a repository of knowledge and a brains-trust for the informal and microenterprise sectors.

Development Bank of Namibia, by design, is intended to finance large enterprises in the first place, as well as SMEs. It does however provide finance through its Apex microfinance facility for qualifying microfinance providers. In this way, the Bank currently complements the development impact of microlenders.

As much as Namibia’s future depends on policy-based lending to finance renewable energy, serviced land, affordable housing and young entrepreneurs, it will also need to develop policy-based stimulus for informal enterprises and microenterprises.

The Board of the Development Bank of Namibia (DBN) has announced that Martin Inkumbi, the CEO of the Bank, will step down from his role in August 2023, at the end of his current second five-year tenure, and he did not seek reappointment after serving ten years in the role.

The Board has since commissioned the commencement of the recruitment process to ensure a seamless transition at the time of Martin’ departure.

During the intervening period, the Board will seek a potential successor in a transparent manner with the assistance of the external recruitment agency. The new candidate CEO will be identified and brought on board for a couple of months to shadow Martin Inkumbi during the remaining stretch and familiarise themselves with the Bank and ensure continuity.

The Board, through its chairperson, Sarel van Zyl, has expressed gratitude to Inkumbi for his distinguished service in leading the Bank and shaping its operations.

Inkumbi joined the Bank in 2006, and progressed through the ranks to be appointed Acting CEO in November 2012. His appointment as CEO was confirmed in August 2013.

On Inkumbi’s assumption of the role of Acting CEO in 2012, the Bank’s balance sheet stood at N$2.03 billion. In 2021, the balance sheet stood at N$9.47 billion.

In addition to growth, Inkumbi has been instrumental in effectively shaping the Bank’s structure and operations.

Among others, Inkumbi has led development and implementation of DBN’s risk management framework, as well as restructuring the Bank’s operations to encompass an SME Finance Department, and Investment Department and a Portfolio Management Department to manage borrowers, post-lending. In addition, he led implementation of the Bank’s Treasury unit and listing of the N$2.5 billion bond programme on the Namibian Stock Exchange.

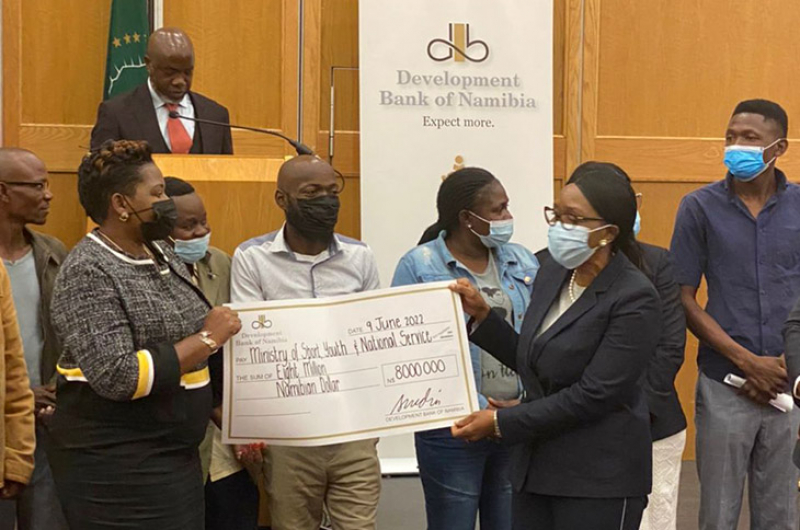

Development Bank of Namibia (DBN), Head of Marketing and Corporate Finance, Jerome Mutumba has announced that the Bank has provided N$8 million to finance 28 rural youth enterprises. A DBN cheque was handed to Deputy Minister of Sport, Youth and National Service to kickstart the 28 start-ups at ceremony officiated over by the Prime Minister, Hon. Saara Kuugongelwa-Amadhila.

Find out more about finance for young entrepreneurs, here...

Speaking about the significance of the initiative, the Prime Minister said the 28 enterprises are part of a wider initiative to provide funding to 121 rural youth enterprises. She said funding for youth enterprises is an important component of Namibia’s goal to achieve sustainable development, under the Fifth National Development Plan (NDP5). The Prime Minister added that the project aims to create 1,210 new, sustainable, permanent jobs.

DBN’s initial involvement consisted of business management training, for 407 young people from the 121 rural youth enterprises, an exercise that involved technical support to the tune of N$1.2 million. This exercise also involved helping the youth identify potential business ideas in their constituencies and developing business plans for such.

Subsequently the Bank has made available to the Ministry of Sport, Youth and National Service, N$8 million to finance the start-up of the 28 enterprises.

Speaking on behalf of DBN CEO, Martin Inkumbi, Head of SME Finance Robert Eiman said the Bank sees threefold value in the initiative.

Firstly, the Bank has as one of its goals provision of finance for young entrepreneurs. The programme is expected to be a seed for the future of Namibia’s economy. Youth enterprise will be the pool from which it draws its future prosperity and employment creation.

The initiative complements existing Bank programmes that provide skills-based finance to young professionals, young artisans and finance for other young entrepreneurs through its SME Finance and Investments departments.

Secondly, the Bank believes that rural enterprise is critical to the future of Namibian prosperity and food security. The fact that the beneficiaries are from rural constituencies will add to attainment of development impact in rural areas.

Thirdly, the Bank is seeking to finance agri-processing, an offshoot of manufacturing, as well as agri-industry which supports agriculture. The agricultural roots of many of the enterprises that will benefit from this initiative will foster secondary value adding to agriculture.

Development Bank has provided the technical capacity to initiate the programme as well as the funding. The disbursement and administration of finance for the 28 enterprises will be managed by the Ministry of Sports, Youth and National Service.

Jerome Mutumba concludes by urging young entrepreneurs to approach the Bank with sustainable business plans to apply for finance as SMEs or to apply for skills-based finance for young artisans or young professionals.